Debt can stealthily accumulate, leaving you shocked when you realize the substantial amount you owe. In my case, discovering a credit card debt exceeding $4000 was a wake-up call. Navigating through such financial challenges can be daunting, but the right tools, like debt payoff apps, can significantly ease the process.

Top Apps for Paying Off Debt

Managing multiple payments can be overwhelming, making the choice of the right app crucial in determining whether you pay off your debts swiftly or not. Each debt payoff app has a unique approach to organizing payments and establishing a repayment schedule. Here are our top picks for the best apps to pay off debt:

1. Bright Money

Cost: $14.99 monthly; $53.94 bi-annual plan; $83.88 annual plan

Platform Compatibility: Android (Rating: 4.7/5), iOS (Rating: 4.8/5)

Bright Money specializes in helping you tackle credit card debts and improve your credit score. By connecting your checking account, the app initiates small transfers into your Bright Stash, separate from your bill payments. This strategic move prevents unintentional overspending, facilitating progress towards financial goals like saving for a downpayment.

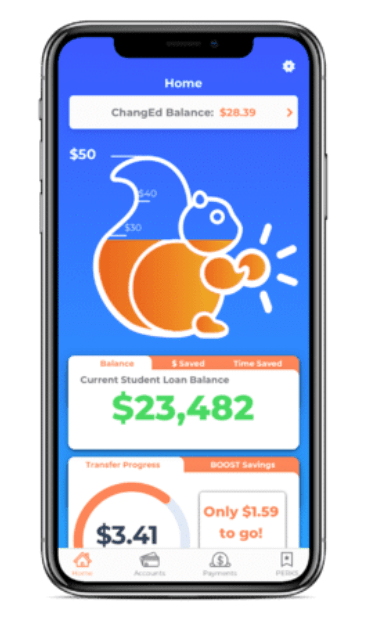

2. ChangeEd

Cost: $3/month

Platform Compatibility: Android (Rating: 4.4), iOS (Rating: 4.7)

ChangeEd offers a focused approach to paying off student loans quickly. The app rounds up your purchases by linking your bank account and credit cards, depositing the spare change into an FDIC insured savings account. When your student loan balance hits $50, ChangeEd makes additional payments, and you can track your repayment progress on the member platform.

3. Digit

Cost: $0 for the first six months, then $5 per month

Platform Compatibility: Android (Rating: 4.5), iOS (Rating: 4.7)

Digit is a versatile app promoting financial health by encouraging saving, cutting unnecessary expenses, and paying down debt. It facilitates automatic transfers by rounding up purchases, allowing these micro-deposits to be invested, saved, or used for debt repayment. The app also calculates a “safe-to-spend” amount, helping you avoid overdrafts.

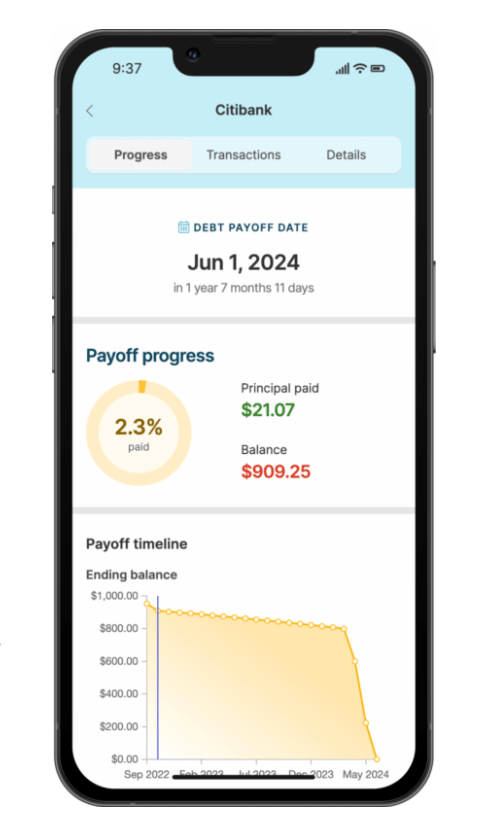

4. Debt Payoff Calculator

Cost: Free

Platform Compatibility: Android (Rating: 4.5), iOS (Rating: 4.7)

The Debt Payoff Planner is a free application offering the choice between debt snowball and debt avalanche methods. By inputting your debts and monthly budget, the app analyzes the data, providing an optimal debt payment plan and the time needed to become debt-free. No login is required, making it easy to get started immediately.

5. Debt Manager

Cost: 99 cents

Platform Compatibility: iOS (Rating: 4.6)

Debt Manager employs the Debt Snowball method and offers various strategies like debt avalanche and highest balance first. The app enables the organization, tracking, and payment of an unlimited number of debts, with features such as introductory rates and flexible payment frequencies.

6. Debt Payoff Assistance

Cost: Free

Platform Compatibility: iOS (Rating: 3.5)

Debt Payoff Assistant, a free iOS app, supports both the debt avalanche and debt snowball methods. It provides tools for tracking repayments, extra principal payments, and includes built-in calculators for debt due dates, mortgages, and loans. The app also generates charts and reports to visualize your progress, serving as a motivational tool.

Consider these apps as valuable allies on your journey to financial freedom, each offering a unique approach to debt reduction.

+ There are no comments

Add yours