Credit cards, a financial tool loved by many, have become integral in our lives. Exploring the fascinating realm of credit card statistics unveils a diverse landscape. Personally wielding multiple cards with distinct perks, including cash-back and travel rewards, my disciplined approach to timely payments places me in the minority. Let’s delve into the realm of credit card usage in the United States and see how it compares to the typical cardholder’s experience.

Credit Card Debt Overview:

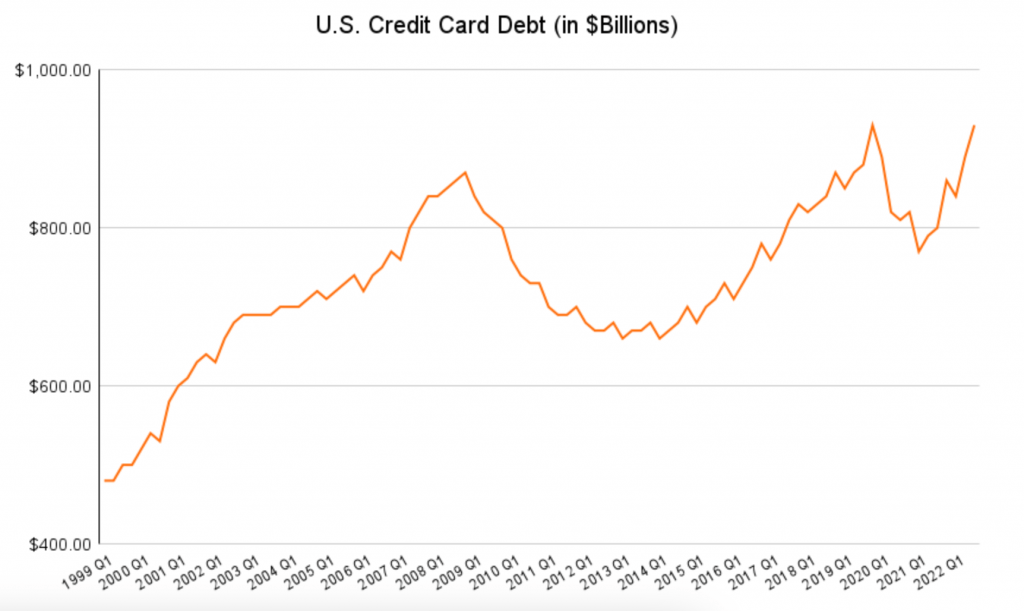

Contrary to my restrained credit card practices, the average American credit card user grapples with substantial debt. As of Q2 2022, total outstanding credit card debt in the U.S. reached a staggering $930 billion. When distributed among the population, this translates to an average credit card debt of approximately $2,810 per person.

For active credit card users, the scenario is even more concerning, with an average debt exceeding $6,000. Notably, the collective credit card debt in the U.S. has surpassed previous records. While this alone isn’t a cause for alarm, the high-interest rates and expanding credit lines raise concerns, especially with economic slowdowns and potential job losses on the horizon.

Credit vs. Debit Cards:

In a surprising revelation, credit cards significantly outnumber debit cards in the wallets of Americans. Despite the convenience of direct fund deduction associated with debit cards, the flexibility of credit cards, allowing balance carryovers, remains more appealing. In 2019, there were 1.08 billion credit cards, including those with debit functions, compared to only 325.4 million debit-only cards.

This preference for credit cards, a double-edged sword offering payment flexibility and lucrative rewards but also posing a risk of high-interest debt, is a noteworthy trend in the financial landscape.

Fraud in Credit Card Transactions:

Credit card fraud, a persistent concern, accounts for approximately 6.8% of all U.S. credit card spending, according to the Nilson Report. While this reflects a slight decrease from the 2016 peak of 7.2%, it remains higher than the 2010 rate of 4.5%. Notably, strict consumer protection laws mitigate the direct impact on individual cardholders, as credit card companies absorb most fraud losses.

Interest Rates on the Rise:

The most alarming trend emerges in the form of rising interest rates on credit card balances. The average interest rate on open U.S. credit card accounts soared to 19.1% in November 2022, reaching historic highs. This significant increase, closely tied to the federal funds rate, raises concerns for individuals carrying balances, as monthly costs escalate.

Available Credit on the Rise:

Despite the record-high interest rates, there is a surprising increase in available credit. Since 2010, available credit has risen from $2 trillion to about $3.5 trillion by Q4 2022. This expansion raises questions about potential consequences if credit utilization rates continue to climb, signaling financial stress at a macro level.

Delinquency Rates and Economic Predictions:

Delinquency rates, a crucial indicator, touched a historic low of 1.55% in Q3 2021 but are now on the rise. Projected to surpass the 10-year high of 2.66% in Q1 2020, the steepening curve suggests a concerning trend. Economic headwinds, inflation, and anticipated unemployment increases in 2023 and 2024 may contribute to a substantial rise in credit card delinquencies.

Credit Scores Amidst Challenges:

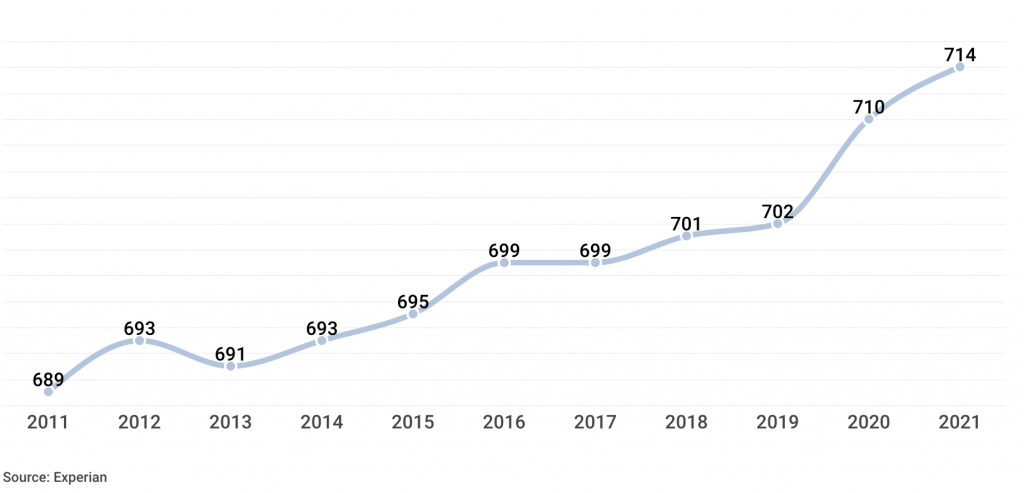

An optimistic note lies in the continuously climbing credit scores of Americans. With the average FICO score reaching 714 in 2021 and remaining within the “good” credit range, there is evidence of responsible credit use. Despite impending challenges such as inflation and a potential recession, a sharp decline in credit scores similar to the aftermath of the 2008 financial crisis is not anticipated.

Conclusion:

In summary, the current state of American credit card users appears robust. High credit availability, elevated credit scores, and timely payments, coupled with stringent consumer protection laws, create a stable environment. However, challenges loom on the horizon with economic uncertainties and soaring interest rates. For those standing at a financial crossroads, the time is ripe to address credit card debt earnestly and navigate through potential storms in 2023 and 2024.

+ There are no comments

Add yours