The Internal Revenue Service (IRS) has announced an increase in the individual contribution limits for 401(k) plans in 2024, allowing individuals to contribute up to $23,000, up from $22,500 in 2023. Additionally, the annual contribution limit for IRAs has been raised to $7,000, compared to $6,500 in the previous year. Exciting news!

Given the evolving landscape of retirement, characterized by a three-legged stool consisting of personal savings, Social Security, and pensions, the increased contribution limits for 2024 become crucial. To keep pace with inflation, these limits must continue to rise, emphasizing the need for consistent savings and strategic investments to outpace the effects of inflation.

For many, relying solely on pensions post-retirement is not a viable option. While having a pension is indeed fortunate, its value often exceeds expectations. Personally, I would choose a lifetime pension over a 401(k) plan any day. The benefits of a pension far outweigh the perceived advantages of a 401(k).

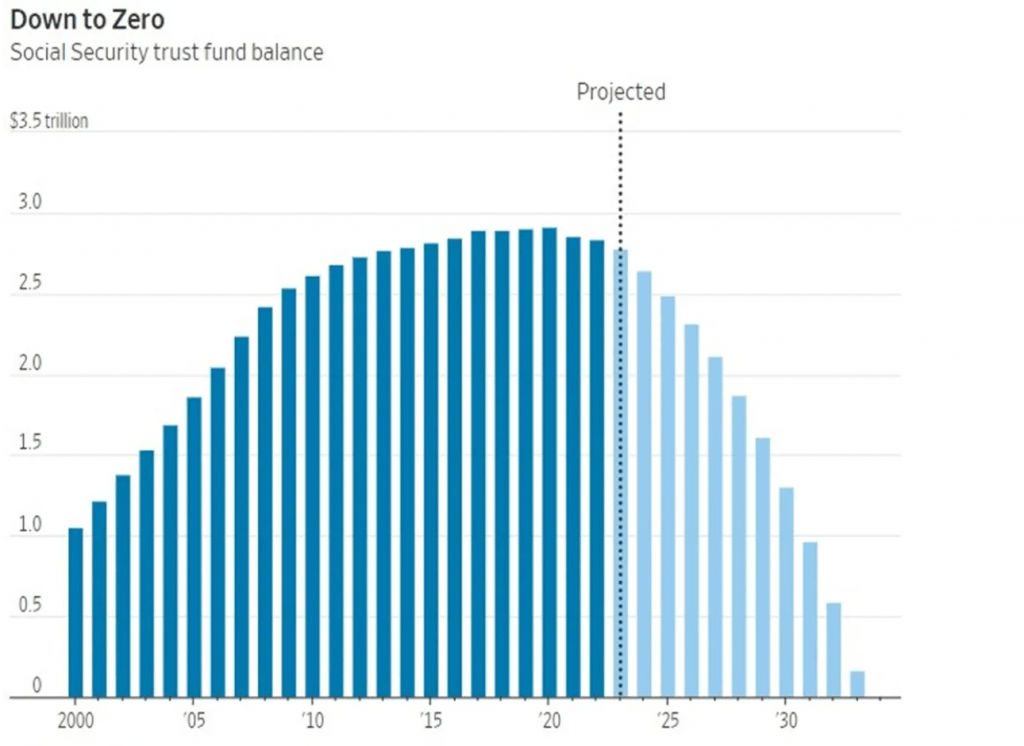

If there’s no adjustment to retirement age or reduction in benefit amounts, Social Security is anticipated to only cover about 75% of the total benefits between 2034 and 2037. With the depletion of Social Security reserves, the ability to pay full benefits is at risk.

Hence, those under the age of 45 should not anticipate receiving 100% of their Social Security benefits. In reality, it’s advisable not to solely rely on Social Security.

Key Highlights of Retirement Contribution Changes in 2024

Here are the key highlights of the retirement contribution limits for 2024. Make the most of them!

2024 Limits for 401(k), 403(b), 457 Plans, and Savings Plans

- Employees participating in 401(k), 403(b), and most 457 plans, as well as federal government savings plans, can contribute up to $23,000, up from $22,500.

- For participants aged 50 and above in 401(k), 403(b), most 457 plans, and federal government savings plans, the catch-up contribution limit remains at $7,500, consistent with 2023.

Therefore, in 2024, employees aged 50 and above participating in these plans can contribute a maximum of $30,500. The catch-up contribution limit for those in simplified employee pension (SEP) and SIMPLE plans remains at $3,500 in 2024.

2024 IRA Contribution Limit

- The annual limit for contributions to IRAs has increased from $6,500 to $7,000. For individuals aged 50 and above, the additional catch-up contribution limit for IRAs, including the annual cost-of-living adjustment, remains at $1,000 in 2024.

- Eligibility criteria for deductible contributions to traditional individual retirement arrangements (IRAs), investment in Roth IRAs, and the income ranges for claiming the saver’s credit have all been adjusted in 2024.

Income Ranges for Traditional IRA Contributions in 2024

Your ability to deduct contributions to traditional IRAs depends on your income level and whether you or your spouse has a workplace retirement plan.

- For single taxpayers covered by a workplace retirement plan, the phase-out range has increased to $77,000 to $87,000, up from $73,000 to $83,000 in 2023.

- For married couples filing jointly, with the contributing spouse participating in a workplace retirement plan, the phase-out range has increased to $123,000 to $143,000, compared to $116,000 to $136,000 in 2023.

- For married individuals who are not covered by a workplace retirement plan but have spouses who contribute to IRAs, the phase-out range has increased to $230,000 to $240,000, up from $218,000 to $228,000 in 2023.

- Married individuals covered by a workplace retirement plan have an unchanged phase-out range of $0 to $10,000, not affected by the annual cost-of-living adjustment.

(img)

Lower Income Thresholds for Traditional IRA Contributions in 2024

The lower income thresholds for full deductions on contributions to traditional IRAs have been a source of frustration. In 2024, the income thresholds are $83,000 for single taxpayers and $143,000 for married taxpayers, placing them in the 22% marginal income tax rate. Why shouldn’t high-income earners have the same rights to fully contribute to traditional IRAs?

Encouraging everyone to save for retirement, regardless of income, is essential for our citizens’ financial well-being. It’s known that many high earners with six-figure incomes face financial challenges later in life due to a lack of savings.

The income thresholds for contributing to Roth IRAs in 2024 are as follows:

- For single and head-of-household taxpayers, the range has increased to $146,000 to $161,000, up from $138,000 to $153,000.

- For married couples filing jointly, the range has increased to $230,000 to $240,000, compared to $218,000 to $228,000 in 2023.

While it’s reasonable for those falling within the 22% marginal income tax rate to contribute to Roth IRAs, is it fair to exclude those in the 24% and higher income tax brackets? The 24% tax rate is considered middle-class income in higher-cost areas.

Government Savings through Limiting Roth IRA Contributions

Contributing to Roth IRAs may not make much sense when in the 24% marginal income tax bracket. For those in the 32% marginal income tax bracket, making Roth IRA contributions or converting to Roth IRAs may not be financially advantageous.

I doubt most retirees will face a higher marginal tax rate during retirement compared to their working years. Let’s be realistic.

To generate income and distributions of $191,951 or more today, a single taxpayer needs an investment portfolio with a 4% return, totaling $4.8 million. For married couples, a portfolio or net worth exceeding $9.6 million is required. This is unattainable for over 95% of Americans, as the top 1% starts at around $13 million today.

Perhaps the government is indeed considering the financial well-being of those in the 24% and higher tax brackets! It’s worth noting that Roth IRA contributors pay taxes upfront, eliminating the need for tax payments upon withdrawal.

Income Limits for the Saver’s Credit

The income limits for the Saver’s Credit, designed for low and moderate-income workers, are as follows:

- Married couples filing jointly have an income limit of $76,500, up from $73,000 in 2023.

- Head-of-household individuals have an income limit of $57,375, compared to $54,750 in 2023.

- Single and married individuals filing separately have an income limit of $38,250, up from $36,500 in 2023.

- The limit for individual contributions to SIMPLE retirement accounts has increased to $16,000 in 2024, from $15,500 in 2023.

Other Changes under the SECURE 2.0 Act include:

- A cap of $200,000 on premiums paid for eligible longevity annuity contracts, unchanged from 2023.

- Adjustments to the deductible limit for charitable donations, increased to $105,000 in 2024, up from $100,000.

- An increased deductible limit of $53,000 for direct allocations to split-interest entities paid from individual retirement accounts by trustees, up from $50,000.

- For more detailed information on these and other retirement-related cost-of-living adjustments for 2024, please refer to Notice 2023-75 on the IRS website.

Always Maximize Contribution Limits

To ensure a secure retirement, strive to contribute the maximum allowable amounts to available tax-advantaged retirement plans. Additionally, aim to contribute the maximum limits to IRAs or Roth IRAs whenever possible! There’s a good chance your income will eventually surpass the thresholds for IRA contributions.

A benefit of returning to work in 2024 is the opportunity to resume contributing to my individual 401(k) plan. I haven’t consulted it since 2015, and it has fallen behind the age-level I hoped to achieve. In 2024, maximizing my individual 401(k) plan to $23,000 would be a significant accomplishment. Any additional income will be directed towards saving and investing for my children’s education.

+ There are no comments

Add yours