Securing insurance for your rental property is often non-negotiable, but the question arises: What type of insurance is ideal? The conventional homeowner’s insurance policy? Have you considered something called “landlord insurance”? This unique coverage shields your income-generating property from damage or destruction and provides protection against tenant lawsuits. Today, we delve into the specifics of “Stable Landlord Insurance,” a company exclusively dedicated to this niche. While highly recommended, it may not be the one-size-fits-all solution. By the end of this article, you’ll have a clearer understanding of whether Stable is the right choice for your landlord insurance policy.

Understanding Landlord Insurance:

Before we dive into the details of Stable Landlord Insurance, let’s ensure you grasp the essence of landlord insurance and why it’s a necessity. Unlike standard home insurance, which may cover damages to personal residences, landlord insurance is designed specifically to safeguard properties owned for income generation.

Overview of Stable Landlord Insurance:

Established in 2017 and officially founded in 2019, Stable addresses the pain points of property owners seeking straightforward, efficient, and reasonably priced landlord insurance. The company’s founders, faced with the challenge of finding suitable insurance for a small rental property in Chicago, decided to create a company that provides quality coverage with transparent pricing.

Stable’s unique online self-service model introduces experts into your life, facilitating the acquisition of customized coverage with minimal hassle. Servicing all 50 states in the U.S., Stable takes into account the wide variations in insurance costs, positioning itself as an incredibly versatile option.

Is Stable a Financially Sound Company?

A concern for users might be Stable’s relatively recent establishment, lacking a historical track record of handling large-scale claims during significant economic fluctuations. However, the company has raised substantial funds to support its financial stability and ongoing operations. With funding rounds in 2020 and 2021 amounting to $38 million and $27.8 million, respectively, Stable has become one of the fastest-growing insurance companies in the U.S.

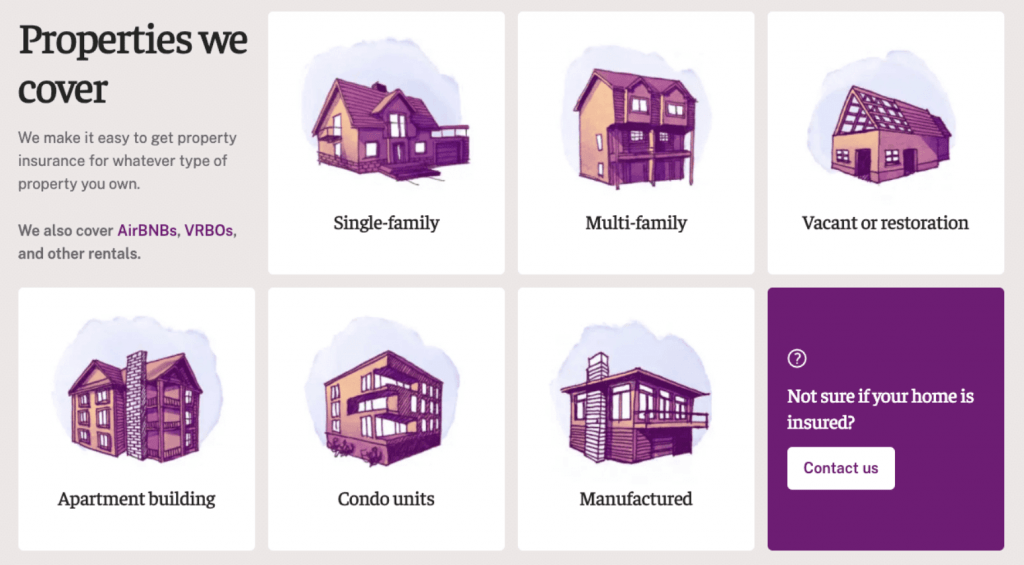

Coverage for Various Property Types:

Stable offers coverage for a range of property types, including single-family homes, multi-unit residences, vacant or under repair properties, apartment units, mobile homes, and apartment buildings. The company also extends coverage to Airbnb, VRBO, and other short-term rental properties, emphasizing coverage for paying guests only, excluding friends and family.

Does Stable Meet Your Needs?

The effectiveness of an insurance policy lies in its ability to cover the events you wish to protect against. Consider the following checklist to determine if Stable provides the protection you seek:

- Fire: Stable covers repair or reconstruction costs for property damage resulting from fires.

- Water: Coverage includes repair expenses for damages caused by burst pipes or roof leaks.

- Storms, Hail, and Lightning: Stable operates nationwide, providing coverage for property damages resulting from storms, hail, and lightning.

- Lawsuits and Injuries: Stable pays for defense or settlement costs arising from injuries on your property, protecting against unforeseen expenses.

- Riots and Civil Commotion: Riot insurance covers the costs of repairing your property in case of violent protests, alleviating concerns about looters and protesters.

- Theft and Vandalism: If your property is vandalized or stolen from, Stable covers the costs of repair or replacement.

Additional Coverages:

Many policies also include additional coverage, such as protection against explosions, damage caused by vehicles, volcanic eruptions, defamation, and mental anguish. Explore Stable’s supplementary coverage options for more details.

Exclusions from Stable Landlord Insurance:

While Stable offers extensive coverage, certain items are not covered, including tenant belongings, mechanical repairs and replacements, damages caused by property owners, renovations resulting in damage, and wear and tear.

Weighing the Pros and Cons:

Like any alternative on the market, Stable has its advantages and drawbacks. Whether it becomes your landlord insurance policy provider ultimately depends on personal preferences. Here’s a quick list of pros and cons to aid in your decision-making:

Pros:

- Specialization in Landlord Insurance: Stable focuses solely on providing insurance for property owners, demonstrating expertise and knowledge in this field.

- Customizable Plans: Tailor your Stable insurance plan to fit your needs and budget.

- Short-Term Rental Coverage: If you occasionally rent your property on platforms like Airbnb or Vrbo, Stable offers coverage.

- Simple Application Process: Unlike many well-known insurance companies, Stable’s application process is online and doesn’t require direct interaction with representatives. Of course, a team of agents is available if needed.

- Local and International Team: With headquarters in Austin, Texas, and agents nationwide, Stable also employs a global team, a common practice among startups. Some administrative tasks are outsourced to employees in China, ensuring the privacy of property owners.

Cons:

- Lack of Bundled Policies: If you seek a one-stop-shop for both landlord and non-landlord property insurance, Stable isn’t the right choice. You’ll need separate policies from different companies.

- Exclusion of Tenant Belongings: Items owned by tenants, such as furniture, electronics, and vehicles, aren’t covered by Stable.

- New Company: As a relatively new company, Stable lacks a track record of handling claims during extreme economic conditions. Despite raising over $31 million in funding, questions remain about its ability to handle large-scale claims.

Conclusion:

My recommendation is to proceed with obtaining a quote from Stable. Evaluate the coverage and premiums to see if the offered solutions align with your property needs. By comparing quotes and coverage from various companies, you can make an informed decision. Choosing landlord insurance is a significant decision, as it involves safeguarding your investments and property.

In conclusion, Stable provides a customizable option, focusing on meeting the needs of landlords. By thoroughly understanding its strengths and weaknesses, you can better assess its suitability for your situation. If uncertainties persist, consult insurance professionals for additional advice. May you find the ideal landlord insurance that ensures the secure protection of your rental property.

+ There are no comments

Add yours