In the realm of debt consolidation, choices matter. Recently, LendingClub unveiled a new section on its website, shedding light on borrower and lender statistics. A standout revelation was that approximately 50% of LendingClub loans are utilized for debt consolidation. While this figure has slightly dipped from the previous 60%, it prompts a closer look at the dynamics between LendingClub and its counterpart, Prosper.

Advantages of Debt Consolidation with LendingClub and Prosper:

1. Fixed Interest Rates:

One standout advantage offered by both LendingClub and Prosper is the provision of fixed interest rates. In a financial landscape where fixed rates on credit cards are a rarity, this feature provides stability. Unlike the unpredictable tales of credit card rate hikes, these platforms offer rates that remain constant throughout the loan tenure.

2. 3 or 5-Year Terms:

Both platforms structure loans with terms of three or five years. Three years is deemed an ideal duration for debt consolidation – striking a balance between reasonable payments and avoiding prolonged interest accrual. The five-year option accommodates those requiring a more extended period to emerge from debt.

3. No Prepayment Penalties:

Despite the loan term ranging from three to five years, both LendingClub and Prosper allow for early repayment without incurring penalties. Flexibility is key, enabling borrowers to accelerate their debt-free journey without additional costs.

4. Streamlined Application Process:

The application process for both Prosper and LendingClub is remarkably straightforward. LendingClub’s online application takes less than 3 minutes, providing instant decisions. A hassle-free experience from application to loan approval.

5. Automatic Payment Setup:

Once the loan is secured, monthly payments are automatically deducted from your checking account, streamlining the repayment process and reducing the risk of missed payments.

6. Confidentiality:

Despite being peer-to-peer lending platforms, both LendingClub and Prosper prioritize user privacy. Your personal and financial information remains secure throughout the borrowing process.

7. Unsecured Loans:

Unlike home equity lines of credit, loans from LendingClub and Prosper are unsecured. While you’re obligated to repay the loan, your home isn’t leveraged as collateral, providing peace of mind.

Borrower Eligibility:

Understanding that LendingClub and Prosper have distinct eligibility criteria is crucial. Here’s a concise summary of LendingClub’s borrower requirements:

- U.S. citizen or permanent resident

- Minimum age of 18 with a valid bank account and social security number

- FICO score of at least 600

- Debt-to-Income ratio (excluding mortgage) below 40%

- At least 3 years of credit history with no current delinquencies, recent bankruptcies (within 7 years), public tax liens, charge-offs, or non-medical collections in the past 12 months

- A maximum of 6 credit inquiries on your credit report within the last 6 months

- At least 2 open revolving credit accounts

Prosper requires a FICO score of 640 and doesn’t impose a debt-to-income ratio requirement like LendingClub.

Your Credit Score and Debt Consolidation:

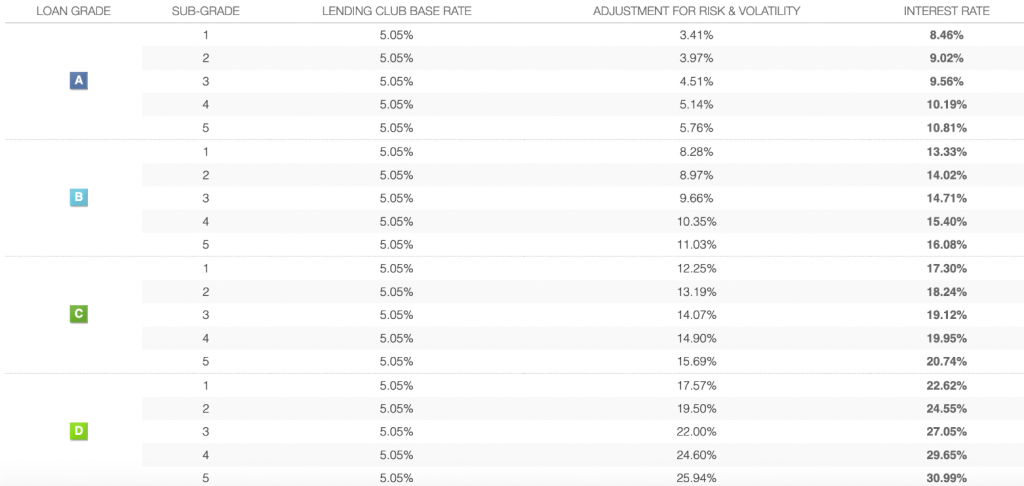

Your credit score plays a pivotal role in determining loan eligibility, interest rates, and fees during the debt consolidation process. Take a moment to peruse the LendingClub rate table screenshot below:

Application Process:

Applying for a debt consolidation loan is a straightforward process. Both LendingClub and Prosper allow you to check your rates without impacting your credit score. In a matter of minutes, you can determine the rates you qualify for on both platforms.

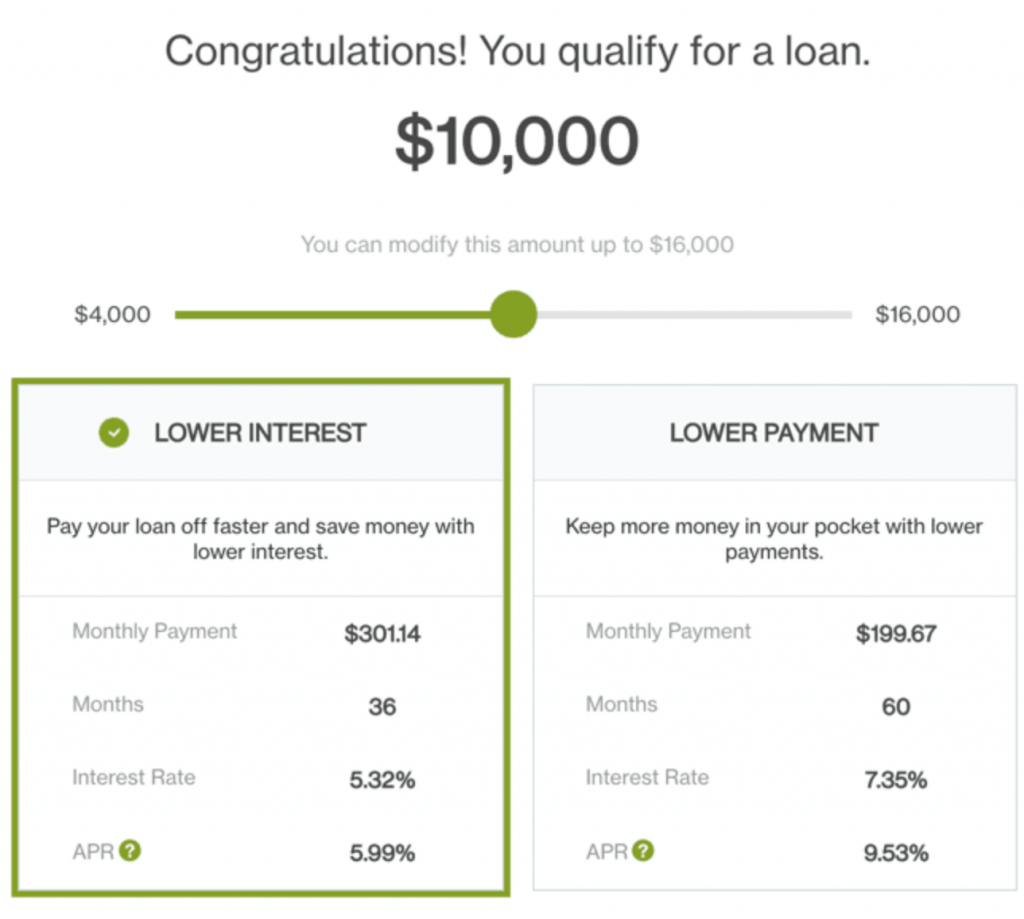

Prosper Example:

In about 2 minutes, I checked the interest rate for a $10,000 debt consolidation loan on Prosper. Here are the results:

Keep in mind that your rate may vary based on your specific circumstances.

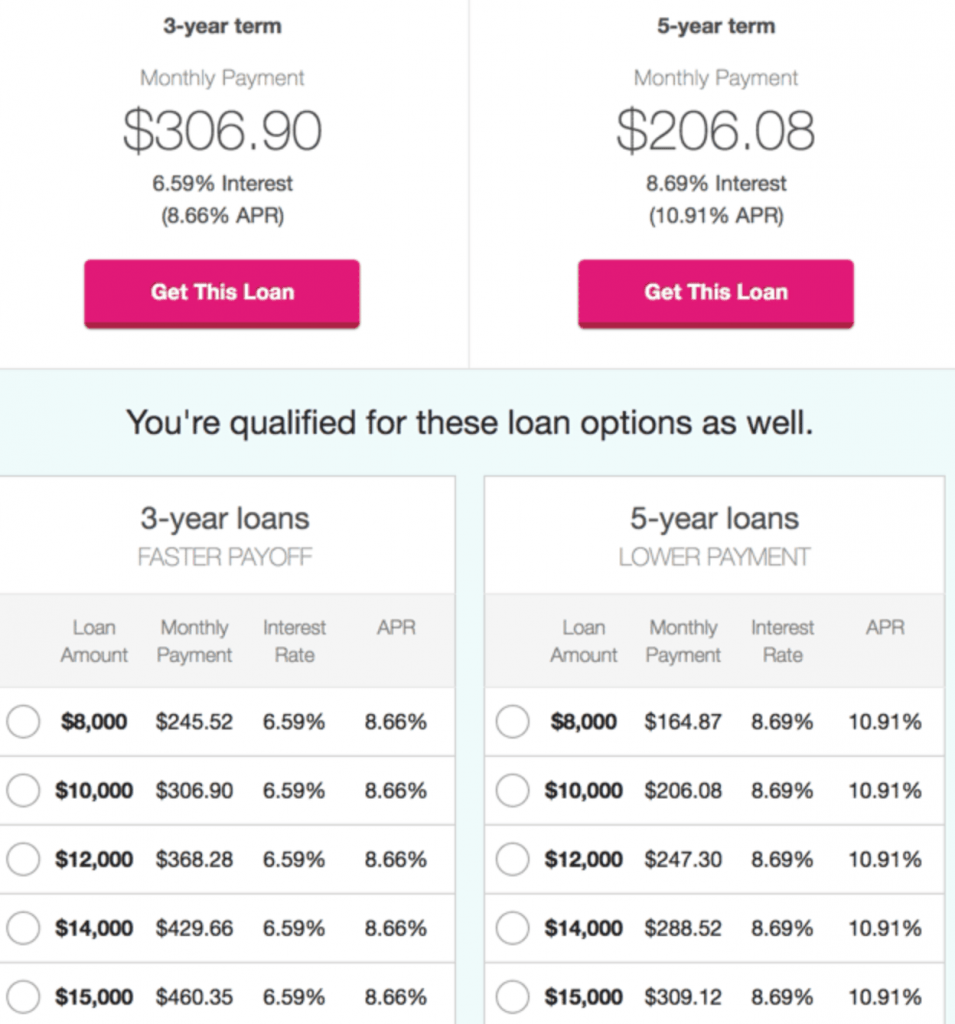

LendingClub Example:

Similarly, LendingClub swiftly provided the rate for consolidating my debts after inputting the same information:

As with Prosper, your rate on LendingClub may differ based on your individual profile.

Loan Terms Matter:

On peer-to-peer lending platforms, loan terms rarely exceed five years. While the interest rates for 5-year loans might appear higher, the good news is that due to the relatively short duration of both loans, the interest rate difference between 36-month and 60-month loans isn’t substantially impactful over the long run.

In conclusion, though you may pay less interest with a 3-year loan, the ability to afford the payments on a 3-year loan is a crucial consideration.

By comprehending the unique advantages and borrower requirements of LendingClub and Prosper, you can make an informed decision on which platform aligns better with your financial goals. Whether you’re on a mission to consolidate debt or embark on a debt-free journey, these platforms offer viable solutions tailored to your needs. Remember, every financial decision today shapes a more secure financial future tomorrow.

+ There are no comments

Add yours