In the next few years, Roth IRAs that are tax-free now will gain in popularity. I’ll explain.

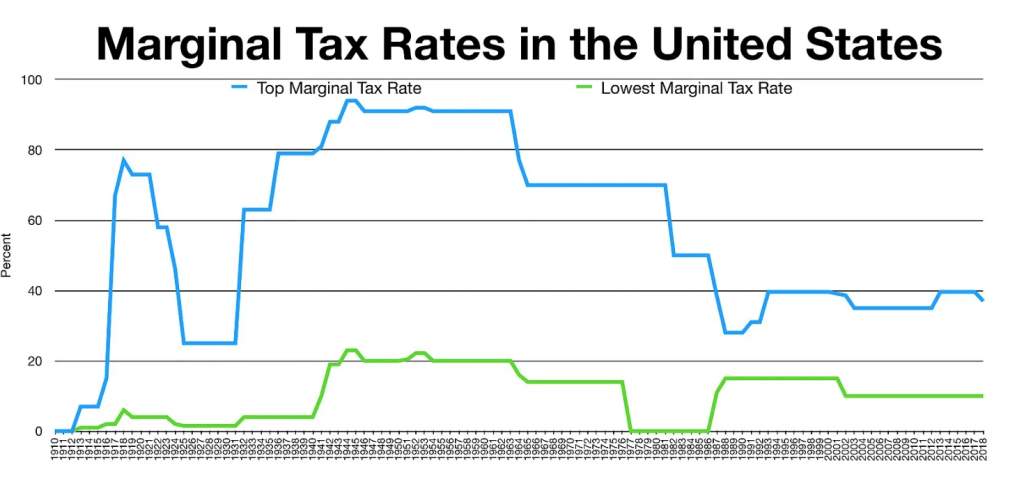

The Tax Cut and Jobs Act of 2017 was passed by Congress in 2017. This law began an eight-year period with the lowest rates of taxation ever seen in the United States, starting on January 1, 2018

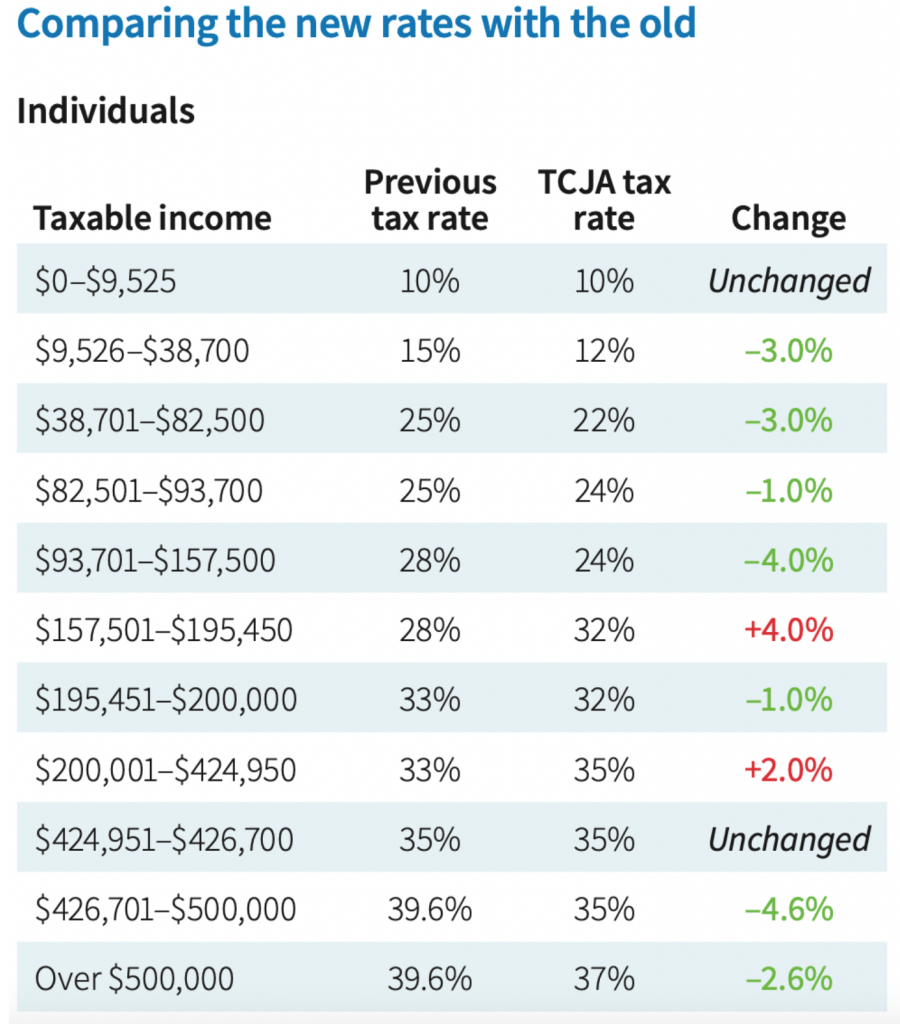

Due to the sunset provision that was written into the law, however, the sale of taxes ends December 31, 2025. The taxes are set to return to pre-2018 levels in January 2026 if Congress doesn’t act, as they usually do. The marginal tax rate can increase anywhere between 1% and 5%.

The logical answer is to convert some of the tax-deferred money you have in your 401 (k)s or traditional IRAs, into a Roth IRA that pays taxes immediately. You can save money on taxes by doing this, especially if the tax rate is higher in your retirement years.

How much money from your deferred tax retirement fund should you transfer? What marginal tax bracket do you need to be in to contribute to a Roth IRA or convert it to one to reduce future tax liabilities?

This chart compares the old marginal rates to the new marginal rates following the TCJA. This chart shows what the marginal tax rates may be in 2026 if Congress does not act.

History of the Roth IRA

Since 2002, when I reached the age of 25, I was unable to make contributions to a Roth IRA. Because of the arbitrary limits on income, I was unable to participate in the Roth IRA.

After I quit banking in 2012, my income dropped by 80%. Taxes were the last thing on my mind. To be able to survive an uncertain future, I would rather hold on to as much cash as possible.

Now that I am older and have children, I believe contributing to a Roth IRA can be a tax-efficient way to diversify retirement income. The TJCA will expire on December 31st, 2025. It’s time to focus on Roth IRAs again.

What is the amount of tax-deferred assets that will be shifted to Tax-Now by January 1, 2026?

We need to assume the following before we can decide whether or not it is better to pay taxes upfront by converting your assets into a Roth IRA that pays tax now:

On January 1, 2026, Congress will allow tax rates to return to their previous levels

Due to a larger deficit, tax rates could go up even more than they were in 2017.

Your tax rate in retirement is higher than the tax rate you paid while working

Let’s get to the point. The vast majority of Americans will not pay higher taxes in retirement. Most Americans spend more than they save. The urgency to move assets out of tax-deferred accounts into tax-now account is therefore low.

Please don’t let anyone fool you when they refer to the Roth IRA retirement plan as “tax-free”. Why can a Roth IRA not be taxed if you must pay taxes prior to contribution? Roth IRAs are a retirement plan that allows you to pay taxes now.

The Roth IRA is a great way to save money. Once you have made your contributions after taxes, growth compounded tax free, and withdrawals are also tax-free after 5 years. There is no such thing as a free lunch for the government.

Roth IRA contribution are only tax-free if you contribute and earn less than the standard deduction. For those who are students or part-time workers, as well as for people just beginning their careers, a Roth IRA is a great option.

Average American retirement tax profile

The median retirement account is approximately $100,000. Also, we know that the average Social Security payout is about $24,000 per year.

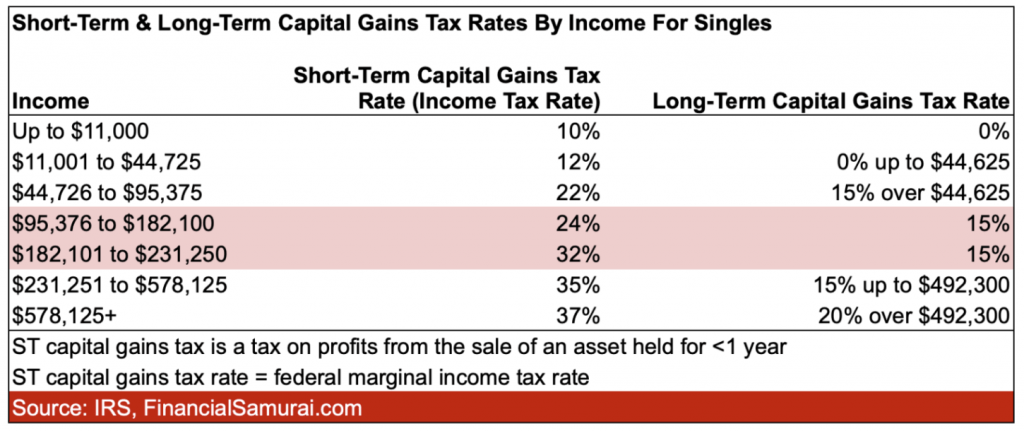

If you were to withdraw $10k a month from the median retirement account, then your annual income would total $34,000. ($24,000 plus $10,000). This income is within the marginal tax rate of 12%, which makes it a low income. The 12% rate of tax and the income threshold for 2023 is $44,725 seems to be unlikely to go down.

One could say that the American average in the 12% federal marginal income tax bracket would be wise to contribute whatever they can to a Roth IRA. The next tax bracket increases by 10%, to 22%. This is the biggest tax increase of any tax bracket.

No tax increases for the Middle Class

We know that politicians are driven by power, so we understand raising taxes will make them lose their power. There is no chance that politicians would raise taxes for anyone or any household earning less than $100,000.

Politicians will not raise taxes for people earning less than $250,000. Biden promised to the public that he would not raise taxes for Americans earning less than $400,000. A $150,000 buffer will be more than sufficient to protect you from any future tax increases.

No one knows where the tax brackets are going to be in the future. We only know that the tax brackets have been decreasing since 1950. Once you give people what they desire, they will not want to lose what they already have.

Mass Affluent Americans Tax Profile

Let’s assume you are a Financial Samurai regular reader. In the end, 33 percent of readers have an income above average of $100,000 to $200,000. In total, 18% earn more than $200,000 per year. 17% make $75,000 to $100,000.

Your net worth is also above average. You have an average net worth between $300,000.00 and $1,000,000.00. 25% of your net worth is over $1 million.

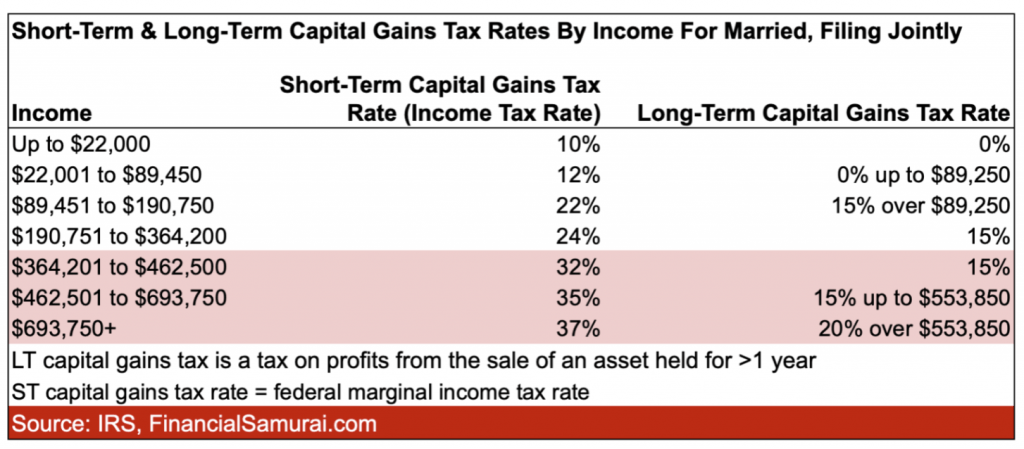

You will be subject to the federal marginal income tax rate of 24% or 32% if you have a profile that includes income and wealth. Individuals’ income ranges from $95,376 to $231,250. For married couples filing jointly, the income range is between $190.751 and $462,500.

It makes no sense for those who pay a marginal tax rate of 32% or more to transfer funds into a Roth IRA. In retirement, you are unlikely to pay a marginal tax rate equal to or greater than your current one.

Roth IRA Tax-Now: 32% Marginal Federal income to Contribute

Assume you earn $182.101. This is the minimum income level that triggers a federal marginal income tax of 32%. To generate $182.101 of retirement income at a 4% rate, $4,552,525 would be required in capital.

You would still need to have $3,552,525 saved up in retirement funds to pay a marginal rate of federal income taxes in retirement.

Let’s say you earn $231.250. This is the income level that will pay a marginal rate of federal income tax at 32% until the rate increases to 35%. If you withdraw 4% of your capital, it would take $5,781,250 to produce $231,250.

If you receive $40,000 per year in Social Security and lower your threshold income to $191.250, then you would still require $4.781,250 to equalize your earning income, as well as pay the 32% federal marginal income tax.

It is my firm belief that the majority of readers who read about personal finance will retire as millionaires. It is not likely that the vast majority of personal finance readers who are mass-affluent will retire millionaires.

It is unlikely that tax rates will increase for people earning less than $250,000. The marginal rate of federal income tax is 32%, which is 10% more than the $75,000 median household income.

It’s a wash for the Federal Income Tax Rate of 24% Marginal

Even if your taxes don’t increase if you earn less than $250,000, there is a higher likelihood that your taxes won’t go up.

Individuals who earn between $95,736 and $182,100 (the 24% income tax bracket), depending on their location, can enjoy a middle class lifestyle. You are among the most sought-after voters if you earn between $95,736 and $182,100 (24% marginal income tax bracket).

The best way to pay taxes and live a good life is to earn $182.100.

The thing is. It’s not easy to accumulate $2,393,400 by age 60, at a rate of return of 4%, to produce $95,736 as retirement income. The median retirement account is around $100,000.

You would still need to save $1,893,400 for retirement if you were only receiving $25,000 in Social Security per year. This is assuming a return of 4%. It’s possible, yes. Most likely not.

The best case scenario for the majority of workers who fall into the marginal tax bracket of 24% is therefore a push. You will be taxed at the same rate as when you were working.

The Future of Tax Frauds Committed by Married Couples Filing Jointly in 2026

The following is the tax rate for married filers jointly in 2018, before and after the TCJA, to give you an idea about what rates might be in 2026. It is significant that a 4% tax increase could be possible.

You can lower your retirement tax bracket by using the standard deduction

The standard deduction will reduce your income even if you have paid off your mortgage in retirement and lost all of your itemized tax deductions.

For the tax year 2023, the standard deduction for married individuals filing separately and jointly increases to $27.700, an increase of $1.800 over last year. The standard deduction for single taxpayers or married couples filing jointly will rise to $13,850 in 2023.

As an individual you can earn a gross of $58,575 while remaining in the marginal tax rate bracket of 12%, even though the marginal tax rate bracket for 22% starts at only $44,766. Gross income of $58,575 minus the standard deduction of $13,850 equals $44,765.

In 20 years at 3% per year, the standard deduction for a single taxpayer will increase to $25,000. For married couples filing jointly, it will reach $50,000. According to the most recent Social Security cost-of-living adjustment, I am confident that the standard deduction will also continue to rise.

Roth IRA contributions are best made with the marginal federal income tax profile of 10% and 12%

Say you’re a young employee paying 10% or even 12%. It is likely that you will have future income to be taxed at a higher rate. You may be able to get a 0% federal marginal income tax due to your standard deduction. If so, you should put as much as possible into a Roth IRA.

Tax-free compounding is a great way to save money and you can withdraw your money at any time. Roth IRAs are tax-free in this instance.

It makes sense to convert some of your money into a Roth IRA if you’re an older worker and find yourself underemployed one day or without a job.

It is best to convert your Roth after retirement, when you are in a tax bracket that’s lower, and before claiming Social Security.

It is difficult to contribute to a Tax-Now Roth IRA if you are losing income

It’s hard, in my opinion, to pay tax to fund a Roth IRA if you are out of work or don’t earn as much money as you used to.

2013 was the year I made my least money since 2003. In 2012, I received my severance payment and no longer receive a salary. So, I would have been better off converting some of my 401 (k) funds into a Roth IRA.

It was the last thing on my mind to pay taxes on my retirement funds. It was hard to accept that I’d quit a good-paying career at 34.

In my life after retirement, I also wanted to become a fruit grower in Oahu. Then I would have a lot of time to pay a lower marginal rate and convert funds into a Roth IRA.

My income rebounded because of my investment recovery from the global economic crisis. Financial Samurai also grew, and I was offered random jobs such as writing a book and startup consulting.

After 2026, higher taxes are not guaranteed

In 2012, I wrote my first article, The Disadvantages of a Roth IRA, under the Obama Administration. This post generated a great deal of controversy, as I expected. Most commenters stated that tax rates will only increase.

Trump was elected president and in 2018 the Tax Cut and Jobs Act passed. Tax rates decreased as a result. Anyone who converted money into a Roth IRA, or contributed to a Roth IRA under the Obama administration was making a poor financial choice.

It is safer to assume that tax rates will increase, given we have now the lowest rates ever and an expiration date of December 31, 2025. The same as saying that interest rates would likely rise in 2020, given that the yield on the 10-year bonds dropped to just 0.56%. We didn’t even buy any bonds.

We are buying Treasury Bonds with yields of 5%+ today in the hope that rates will eventually fall. Maybe shifting assets to tax-now vehicles from deferred tax retirement accounts is a good way of diversifying retirement income.

Roth IRAs don’t have any required minimum distributions. These distributions do not count towards calculating Social Security taxes either.

You can rely on politicians to keep tax rates low

Congress excels at doing nothing. To pay for the massive expenditures we have made since the outbreak of pandemic, we also need more tax revenues. The probability of tax rate increases beyond 2026 has reached its highest level in recent memory.

But I also count on the desire of all politicians for power. You are reluctant to give up power when you already have it.

The elite colleges are holding on to legacy admissions. The colleges know that legacy admissions favor the rich majority. Elite colleges, however, would prefer to abandon SAT/ACT requirement in order for them to have greater flexibility in determining the incoming class.

Therefore, I give a mere 20% chance that the tax rate will increase in 2026 for those earning less than $250,000. The probability may be higher for households earning over $400,000.

As we saw with the inflation rate in 2022-2023, there could be temporary increases in tax rates. Raising taxes in the long term is political suicide.

+ There are no comments

Add yours