Why plan for retirement at such a young age?

This is an excellent question. Many people don’t even begin to think about retirement until they are in their 30s. It may seem unconventional to start a Roth IRA in your child’s name, but this is the best thing you can do for his or her future. Why? Review a few facts about a Roth IRA and its advantages:

Roth IRAs, also known as Individual Retirement Accounts or Roth IRAs, allow you to invest your earned income after-tax.

No minimum age is required to open a Roth IRA.

You can invest as much money per annum as you want, up to a maximum of $6,000 or the income your child earns.

Your child does not need to make contributions, however they cannot exceed their annual income or $6,000 You have a lot of flexibility when it comes to funding your child’s savings account.

The funds invested and the interest they earn are tax free. They can also be withdrawn without tax at age 59 12.

You earn compound interest, which means you get returns on top of returns. You earn returns both on the contributions you make and any returns they earn. This is the main reason you should invest early.

Roth IRAs offer the same flexibility when it comes to withdrawals before retirement. Your child, for example, can withdraw up to $10,000 toward the purchase of their very first house without incurring any penalties (including tax penalties or early withdrawal penalties). It is for this reason that a Roth IRA is a rarity.

What is a Roth IRA and why should you have one?

Why a Roth IRA and not a Traditional IRA? The difference is that traditional IRAs use pre-tax dollars whereas Roth IRAs only accept post-tax money.

A Traditional IRA is not tax-efficient when you contribute to it, because your child will have a very low income tax bill.

Your child’s withdrawals from a Traditional IRA will be subject to income tax. Roth IRAs are the opposite of Traditional IRAs.

The Goal

We’ve already shown you how to do it. We’ll now look at our goals in explaining why it is important to open a Roth IRA as quickly as possible for your child.

Compound returns

The compounding of returns is the main reason to open a Roth IRA account for your child. The returns are compounded every day that you keep your funds in the Roth IRA, allowing a portfolio to grow exponentially if you start investing early, as we did. If you combine our excellent timing and a modest annual contribution, your child could be a multi-millionaire when they retire. See? Not click-bait. Let’s prove this in the next example.

Do you think that investing instead of saving is the better option? This is not true. Savings accounts that we used to think of as our safe haven are no longer a good investment. The “Premium Savings Account” yields 1.5% per year. The upside is that you can earn 1.5% a year. The inflation rate is at 3% annually. Roth IRAs can be both a tax destroyer and an inflation destroyer.

Remember that the road to FI always involves the long term. Simple returns are the norm for most basic accounts like saving accounts. Compounding returns are necessary to get your money working the hardest. It isn’t a quick-and-dirty financial strategy. This will pay off for you in ways that you never thought possible if patience and discipline are applied.

Lifelong Lessons

You should teach children about the importance of financial independence as early as possible. This can be done by showing the child how their portfolio is growing and its balance. It creates a habit by showing financial growth and contributing consistently over time.

This will help your child to understand the value of FI. They will also start on their FI journey earlier. It is a valuable asset. Even those of us in our teens who wish to have started earlier, how many do you think? How many of us, even those in their late teens, wish we started our path earlier? We all do.

In a moment, we’ll give you some examples. But first let us tell how it works with your child. As always, every great tale has a hidden monster. He’s small and we will tackle him first. So don’t run under the bed yet.

Roth IRAs for Kids Stipulation

Like most opportunities, however, the catch is that your child has to have earned an income. This is defined by labor compensation. This also has specific tax implications, since you don’t usually file taxes for your child. Take a closer look at the concepts.

Earned Income

The IRS has provided some guidelines on how to define the earnable income of children younger than 13 years old.

The allowances are not included in the calculation of earned income. Making your bed does not count towards earned income (e.g. Cleaning the house or mowing your lawn can be considered earned income.

When your child reaches the age where they can leave the house, you are allowed to allow them to do the following:

- Babysitting

- Delivery of newspapers

- Move lawns to other households

- We all did it to be hired by ChooseFI.

- Working for an enterprise owned by your parents

Your child can work in public or private firms under certain conditions (which brings them within the tax code standard) when they reach the age of 14.

The Rub on Tax Filing for Children

Please check the state’s tax code for any tax implications and qualifications. This link will give you a general idea of what is required: Children’s Tax Filing.

Please consult your tax accountant or brokerage for further information on the filing and reporting of taxes. There can’t be a “blanket approach” as each state has its own tax codes. The only catch is that you must first set up your child’s Roth IRA. This obstacle will be small. You’re going to see.

Start Early to Get the Best Returns

Let’s get into specifics. See how much of a difference it can make to start early. It’s the difference between several thousand dollars and one million dollars.

Please excuse the generalization.

Roth IRA contributions can make your child a millionaire

This is the biggest one.

Johnny mows lawns when he is nine years old. He’s busy. Johnny and you decide that saving $3,000 in a Roth for the future is the right decision. This situation can be approached in two different ways.

Johnny is able to contribute his entire salary, leaving him $1,000 for the whole year.

Johnny and you can agree that Johnny will pay the difference (Y) and the parents will each contribute a certain amount (1,001, 2 000, or $2,500). This will be covered in more detail under the Psychology section.

Johnny would be worth $123,945 if he put $3,000 into his Roth IRA when he was 9 years old and didn’t touch it until he turned 64. We want Johnny to become a millionaire. It would probably take you tens to thousands of dollars a year up until the age of 64.

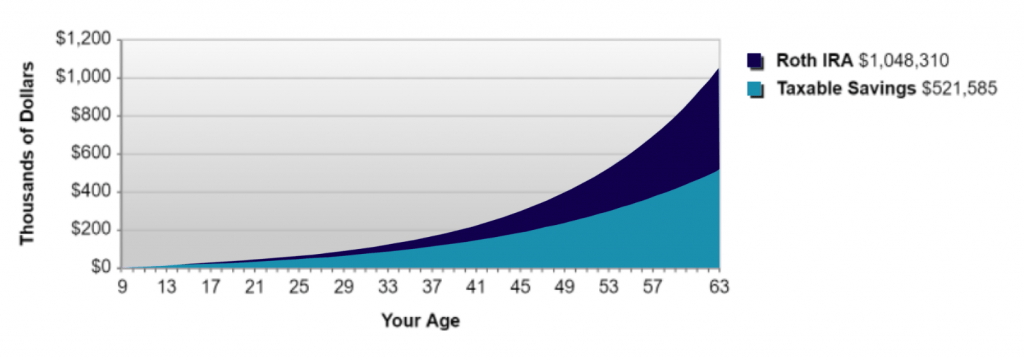

Johnny would become a millionaire if he added $1,500 yearly to his Roth IRA from the age of 10 until 64. To be precise, he’d be worth $1,048,310! It’s tax-free!

Still Not Convinced?

Let’s look at a real-life example to see if you’re not convinced by the effect compounding has in this case.

The average age at which Americans begin saving for their retirement is 31. Roth IRA contribution maximum is $6,000 per annum. Contributions are made every year from the age of 31 up to 64. What’s the result? Your total will only be $764,145.

If you had started your Roth IRA 20 years ago with half of the initial contribution plus one-quarter each year, you’d be about $250,000 ahead. It is for this reason that you should start your child’s Roth IRA early.

What a difference even if you make a single contribution

Johnny does not start to work until the age of 14. Johnny gets hired at a coffee shop in the locality. He earns $7,000 per annum in taxable income. You don’t currently have the resources to help him add to his Roth IRA. However, since you are working towards FI, you want to show him that investing is a good way to achieve financial independence.

Both of you agree to put $2,000 (total $4,000) into your Roth IRA for one year. Johnny would be worth $126,076 if he were to keep that money in his Roth IRA up until he reaches 65 years old (this does not include any additional contributions).

If you invest $4,000 in your Roth IRA at 31 years old, you will have $39,912! This is similar to our first example where Johnny was a millionaire. You would have tripled your money if you had invested the same amount of $4,000 17 years ago.

Graph of Roth IRA growth and taxable saving

The impact of small contributions over time

Johnny begins a newspaper route when he is 7 years old. He earns $300 per year. Johnny hasn’t yet decided to spend his newfound money. Here is a great time to learn about the psychology behind FI. (We will dive deeper into this topic soon). Open a Roth IRA in the name of Johnny. It costs $300. Start by showing him the benefits of investing. He’s only 7, but it is important to instill good habits early.

Johnny will have earned $171.721, if he makes $300 in his first year and $300 a year until he is 60. You’ve also introduced him to an investment lifestyle you believe will yield even greater returns over time.

New Trust Fund

You can see that a Roth IRA is able to replace your child’s trust fund quickly. It’s a no-brainer to choose a Roth IRA for your child as quickly as possible because of the unique tax structure. Imagine the financial power of a Roth IRA combined with a trust. With simple planning and a relative small investment, your child can achieve FI.

The Psychology of Teaching Early Your Child About Investment

We’ve already covered why a Roth IRA is a great financial option for kids. Let’s look closer at the positive long-term psychological effects that come from teaching your child to be FI early.

As you have seen, teaching your kids about FI can be a very important thing. The benefits of FI don’t stop at having a million dollar nest egg. We all wish that we started investing in FI earlier. We all wish we had a “do over” button when we knew we could have taken better, more disciplined, and focused decisions. Teaching your children the importance of investing and the benefits to their future, is the same as raising them to pursue their dreams. FI means more than just financial independence. It also includes time independence.

The Path to FI

Money is something we all understand. Money is something that even a small child can understand. We all want independence, which is why we put the “I” into FI. Take that idea and apply it from a child’s perspective.

Your child is not working for survival. Despite labor laws, all parents want the best for their children. It is not a good idea to “put them to work”. Ask any parent to explain why they let their children work, and you’ll hear: “To teach them about money.” It is an excellent, positive method of raising your child. Add independence to that. It is not as difficult to add independence (since no one forces their children to enter the workplace) than it appears.

Time vs Money Through a Child’s Eyes

This will help your child to understand that they can do anything in their life. The method allows them to live without worry, and do the work that they don’t want. In child psychology, a tool used is implementing a system of rewards that use “monopoly cash” as treats. Straightforward? The twist is: Instead of getting 1 treat now, we can give them 10 instead of 7. It helps a child learn to wait for gratification instead of wanting something immediately. The child “spends” time in order to get a bigger reward.

In practice, this is “time vs money”, the economic principle. Either you spend money or your time. We would all be FI if we had invested in a Roth IRA when we were kids. You can get your children on the road to FI if you teach them the value of money and that delaying instant gratification will lead to a huge payoff.

How can you teach your children to manage their money responsibly? With The Simple Startup Challenge, you can prepare them for the future. You will teach them to be creative, how to solve problems and make wise financial decisions.

Child Development and Parental Engagement

The science of behavioral development between childhood and adulthood is called “Child Psychology.” You will be able to better understand why it is important for you to teach your children the value of FI if you are familiar with the basic psychological concepts.

Children’s Development and Financial Independance

Inherently, children look up to parents to guide them in their behavior. It may seem that your child’s behavior is not changing much, but psychological studies show the opposite. The most significant behavioral changes occur between 18 months and 11 years of age. Jean Piaget, a pioneering development psychologist who studied the field of psychology in depth, created a framework to help break down learning stages according to their age. Warning: Technical Jargon (don’t be alarmed, we will explain it)

From birth to age 18-24 months: object permanence.

2-7 year olds: Symbolic thought (applying learned behaviors, thought to language fluidity, and learning other people’s behaviour).

7-11 Years old: Develops operational thought (logical reasoning, critical thinking and a sense of logic).

Abstract concepts: 11-16 year olds (the ability of a child to visualize ideas which are not visible – the brain, for instance, can be seen visually; however your mind is only conceptualized).

Let’s use this framework to teach your child about the importance of financial independence (ages 2-11).

Permanent Objects

This concept is evidently carried over, even though the breakthrough occurred before age 2. It is important to teach your child the concept of money being a finite resource. This can be done by giving it and then taking it back in exchange for rewards. This is a fundamental building block to the next development step which will be the most important for our FI strategy.

The Symbolic Mind

You can be a role model to your child at this stage. Include them slowly in financial decisions. Create your grocery budget with them and ask how many movies you can let them rent on your favorite streaming service. It will help them to grasp the concept of scarcity. As they age, you can also implement disciplined spending habits. Show them what you can buy compared to why you have invested in your Roth IRA and/or other investment accounts (e.g. A poster with a picture of a toy on one side and your child’s Roth IRA account balance on the opposite.

The Operational Mindset

It is at this stage that your child will begin to enter early adolescence. Encourage your child to do extra chores around the home to earn an allowance. It will naturally lead to a desire for a higher income. This discipline will shape the way they view money, and show them how their hard work can lead to more income. Money equals more freedom and opportunities.

It’s a win-win for you and your child

You can also open a Roth IRA with this income. So, don’t forget to show your child their balance often, to encourage him or her to make contributions, and to prove that the growth of the account over the years will more than compensate for the sacrifices made in the near term. You will have a better chance of helping your child achieve their goals if you start teaching them the principles of FI as early as possible. You can be confident that not only have you done all you could to achieve FI yourself, but also you are instilling the FI values into your child for their future success.

The Bottom Line

We could sum up our message with one word: Time.

You’ve seen the power of compounding and how opening a Roth IRA is a great idea for your child. You can easily make sure your child retires a millionaire with the right planning. Don’t let your older child discourage you and make you think that “you’ve missed the boat”. It is better to start early. Even a few years sooner can result in a five-figure boost to your child’s future retirement.

You’ve been shown the importance of teaching FI values to your children as soon as possible. This will not only give your child the opportunity to become a millionaire but also the structure and discipline to decide for themselves to pursue the path of FI.

Freedom is FI. The gateway to an enjoyable and complete life is FI. All of us want the best for our kids’ future.

Please, use this information and empower yourself to help your grandchildren and children to secure their future by giving them the gift of FI Freedom.

+ There are no comments

Add yours