In the wake of the pandemic, many savvy real estate investors find themselves at a crossroads—should they opt for real estate crowdfunding or delve into Real Estate Investment Trusts (REITs)?

With interest rates at historic lows, the demand for real estate has surged dramatically. However, generating the same risk-adjusted income now requires a more substantial capital infusion. The question arises: Why should investors choose platforms like CrowdStreet or Fundrise for real estate crowdfunding over Real Estate Investment Trusts (REITs)?

Real Estate Crowdfunding vs. REITs

Real estate crowdfunding platforms offer investors a direct entry point into real estate investments, while REITs provide an opportunity for broader exposure to real estate without direct ownership of properties.

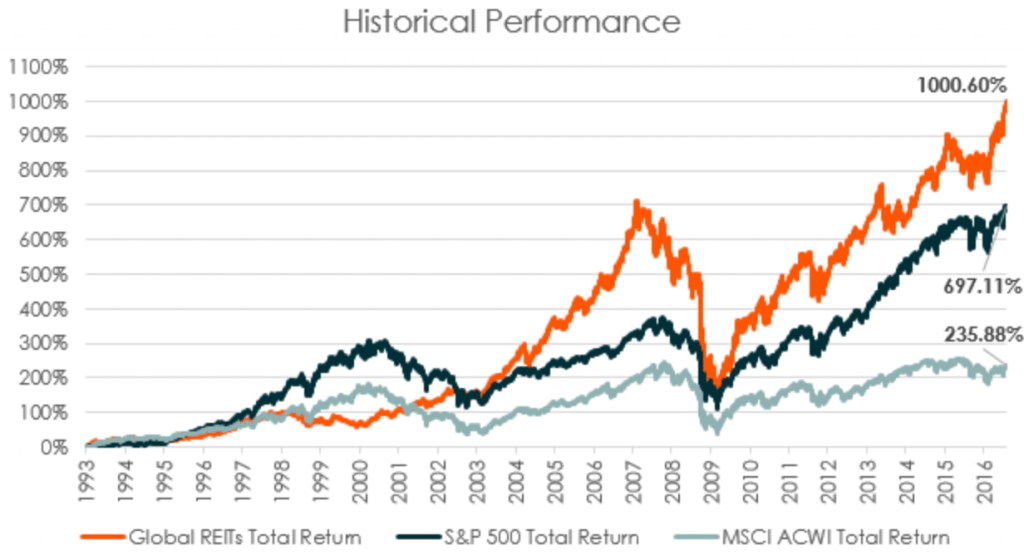

REITs don’t shield against stock market volatility. We’ve witnessed REIT sell-offs that surpassed even those of stocks. Examples and more details can be found here. In essence, publicly traded REITs exhibit a higher beta, or volatility.

If you seek more stable real estate investments, crowdfunding might offer less volatility.

What is a REIT?

A Real Estate Investment Trust is essentially a company that owns and manages a portfolio of income-generating real estate assets, such as apartments, hotels, malls, and office buildings. Mortgages are secured by these properties (Mortgage REITs or MREITs) or a combination of both (Hybrid REITs).

REITs can be private or public. Private REITs are not registered or traded with the Securities and Exchange Commission (SEC), typically raising funds from qualified investors. Publicly traded REITs are SEC-registered and traded on major stock exchanges like NYSE, NASDAQ, and AMEX.

In the U.S., there are over 800 private REITs and 200+ publicly traded REITs with total assets of around $400 billion. Thus, REITs constitute only a fraction of the $11-12 trillion U.S. commercial real estate market.

Some popular publicly traded REITs include:

- Realty Income Corporation (Stock Code: O, Dividend Yield: 4%)

- Omega Healthcare Investors (Stock Code: OHI, Dividend Yield: 7.6%)

Comparison Between REITs and Real Estate Crowdfunding

Real estate crowdfunding and REITs share many similarities. Both offer investors opportunities for balanced and diversified portfolios beyond traditional stocks and bonds. They provide current income from rents and potential long-term appreciation of underlying real estate assets.

Both investment options allow investors to pool capital, providing a less capital-intensive way to invest in a broader range of real estate.

Like Fundrise investments, when you invest in REITs, you are a passive investor. Hence, you need not worry about the day-to-day operations and management of assets; reliable management teams handle these aspects.

Key Differences Between REITs and Fundrise Crowdfunding

The primary difference between Fundrise crowdfunding and REIT investments lies in direct versus indirect ownership. Through Fundrise, you directly invest in tangible commercial real estate. In contrast, with REITs, you invest in a company that allocates your funds to real estate.

In fact, 25% of total REIT investments can be allocated to assets beyond real estate. Therefore, Fundrise offers more control and transparency, allowing investors to individually choose each pre-vetted investment opportunity.

Advantages of Real Estate Crowdfunding Over REITs

- Potential for Higher Leverage and Returns: Direct property ownership benefits from the leverage power (up to 80%), while REITs typically operate with 50% or lower leverage. Higher leverage implies higher potential returns, as you can purchase more properties with less equity.

- Lower Volatility: Despite being touted as an effective way to diversify stock portfolios, REIT stocks closely correlate with overall stock market performance, with a coefficient as high as 0.86 (as early as 2011). This means publicly traded REITs almost move in sync with the entire market. REITs experienced the same volatility witnessed in March 2020. In the same period, private real estate’s stock market correlation coefficient was close to 0.14 (ranging between -0.03 and +0.25; very low correlation).

- More Transparent and Controllable: Directly investing in real estate assets provides clarity on what you are getting. Thus, the process is transparent, and you maintain a certain level of control. On the other hand, when investing in REITs, you invest in a company with a portfolio of real estate. You might not be aware of the exact destination of your investment funds.

Crowdfunding Revolutionizing Investor Access

Until the passage of the JOBS Act in 2012, REITs were the sole option for retail investors. Real estate crowdfunding has made it easier for retail investors to access commercial real estate.

Even if you’re not a qualified investor (with an annual income of $200,000 or a net worth excluding the primary residence reaching $1 million), there’s an option for you. Consider Fundrise’s eREIT offerings.

These are akin to a hybrid of individual real estate crowdfunding investments and private REITs. They come with moderate fees and offer access to more concentrated real estate areas in the U.S.

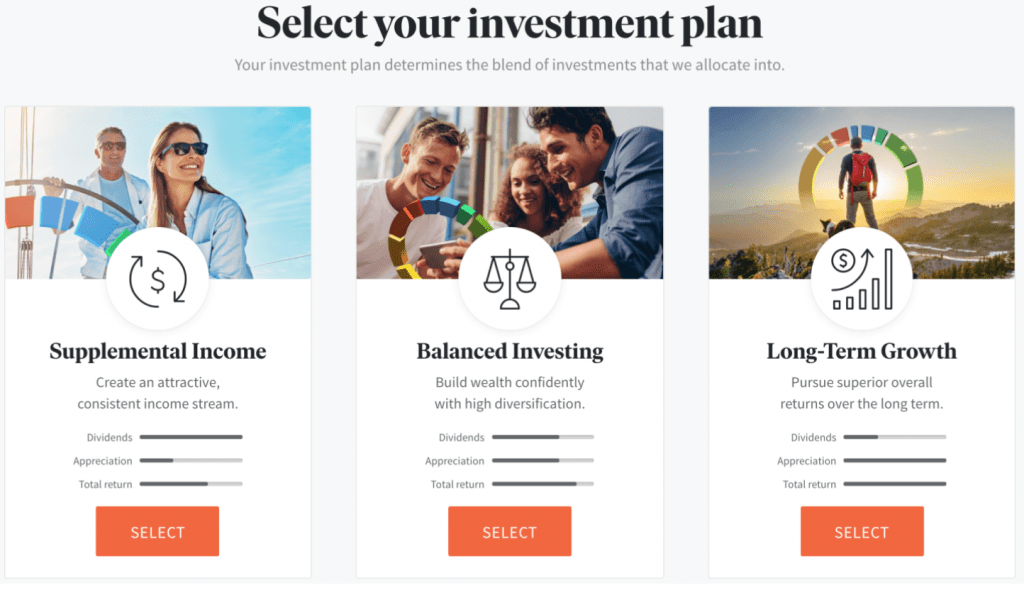

Below are three current Fundrise investment plans that investors can choose from after determining their investment scale. Portfolio investments provide a more diversified and secure approach compared to investing in a single commercial real estate project.

Betting on Real Estate Crowdfunding

In the coming decade, real estate crowdfunding will present a significant opportunity for investors. This technological platform will channel substantial capital from expensive coastal cities to more affordable inland states.

Moreover, post-global pandemic, income growth prospects in heartland zones seem poised for some of the most significant upswings nationwide, especially with the increasing trend of remote work.

Regardless of where you stand on the political spectrum, astute investors always consider long-term changes. Thus, I believe that real estate in the heartland should perform exceptionally well in the next 10 to 20 years.

Why Heartland Real Estate Might Shine

- Migration from Blue to Red States: More people are moving from blue states to red states. Increasingly, individuals realize that living in Texas, for instance, is a great deal if you can get three times as much for one-third of the price.

- Aging Nation and Retirement Migration: As our country ages, more retirees will relocate from blue states to red states to extend their retirement funds.

- Continued Trend of Remote Work: The trend of remote work is likely to persist due to technological advancements and a tight labor market.

- Higher Income Growth in Red States: Due to demographic shifts and corporate expansion inland, red states might experience higher income growth.

Now, with real estate investment becoming more efficient, the capitalization rate of over 10% in red states, compared to less than 4% in blue cities, is hard to ignore. This spread should narrow.

The rise of real estate crowdfunding platforms, such as Fundrise and CrowdStreet, has increased the supply of capital, elevating demand and prices for investments that were previously hard to access. Both are free to register and explore.

Deductions for State and Local Taxes (SALT) are capped at $10,000. Additionally, the mortgage interest deduction limit lowered to $750,000 for mortgages negatively impacts coastal city real estate. But for more states benefiting from the doubling of the standard deduction, this is good news.

I firmly believe real estate will continue to be one of the best ways to build wealth in the long term. Between real estate crowdfunding and REITs, I prefer real estate crowdfunding. I’m not a fan of the volatility in REITs, as evidenced by the stock market crash in March 2020.

+ There are no comments

Add yours