Certainly, being frugal is a vital part of managing personal finances. Wasteful spending won’t increase your income, but attempting to achieve wealth solely through penny-pinching is akin to trying to win a car race by conserving gas. If you aim to reach the finish line swiftly, there’s no room for hesitation on the accelerator!

Today, let’s explore a more effective approach to growing your savings. Let’s discuss how to earn more money. Regardless of whether you’re self-employed or working for someone else, your income hinges on three key factors:

- Your knowledge and skills: Learning more is a worthwhile investment if you aspire to earn more.

- Your work efficiency: Both the quality and quantity of your work impact how much people are willing to pay.

- Your ability to market yourself: To secure the compensation you deserve, you must effectively communicate your value. If the goal is to increase your income, you must enhance your value in the workplace and effectively demonstrate that value to the market. Let’s delve into how to achieve this.

Acquire More Knowledge, Earn More

In the United States, the influence of education on income surpasses that of any other demographic factor. While age, race, gender, and location play roles in determining income, nothing surpasses the significance of what you know. This is positive news since you have complete control over your educational pursuits.

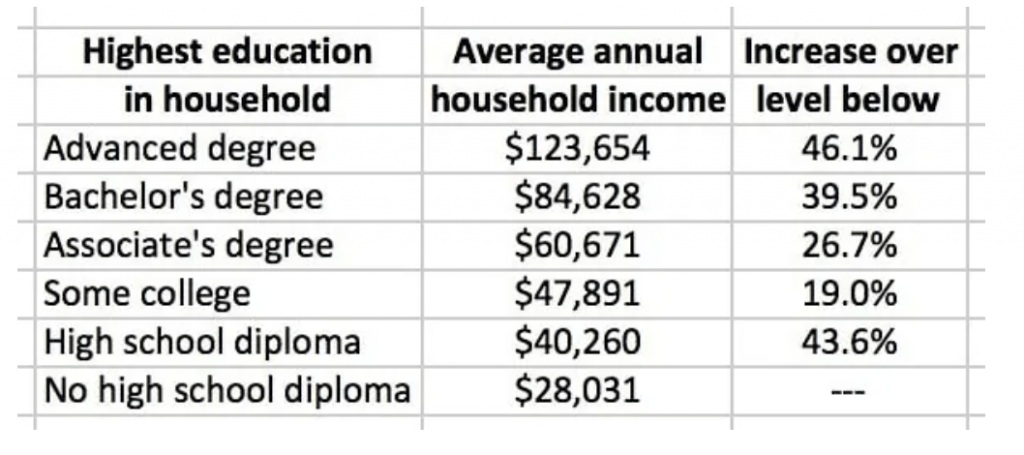

How crucial is education? Consider data from the 2014 Consumer Expenditure Survey conducted by the U.S. Bureau of Labor Statistics:

- The average income of a college graduate is twice that of their high school graduate peers.

- Even a two-year degree from a community college proves beneficial. The annual income of an average worker with an associate degree is double that of a high school dropout and 50% higher than someone with only a high school diploma. Two years of community college typically yield a $20,000 annual income increase. (Over a standard 40-year career, this amounts to nearly a million dollars!)

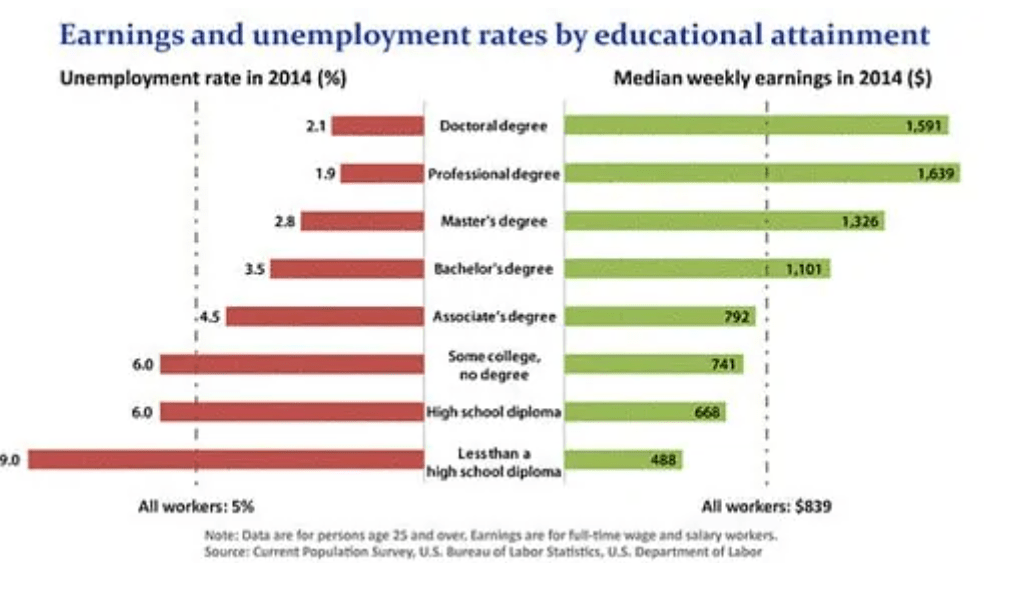

Similar studies from the current population survey also indicate that education affects unemployment rates:

Certainly, a college degree doesn’t guarantee a higher income. Some philosophy majors spend their entire lives working in convenience stores, while some high school dropouts become billionaires.

In general, the more you learn, the more you earn.

It’s optimal to pursue education early in your career, followed by ongoing efforts.

I understand that finding time and energy to return to school can be challenging once you have a family and career, but it’s feasible. Consider the following examples:

- After ten years as a used car salesman, my friend Jeremy decided to become an accountant. He continued selling cars, spent time with his family, and engaged in online courses while preparing for exams. Today, he is a full-time certified accountant.

- Kim, my girlfriend, served as an office manager at a large dental clinic near Sacramento. At the age of 35, she decided she wanted to earn more. She resigned, pursued a degree in dental hygiene, and now enjoys a higher salary and increased job satisfaction.

- I also underwent a similar experience. In 1997, at the age of 28, I took computer programming classes at the local community college, attending evening and weekend classes. Eighteen months later, equipped with enough skills, I took on programming jobs alongside my main sales role at a family-owned cardboard box factory.

If attending college is not feasible, continuous self-education remains a viable option to enhance your knowledge and skills.

I strongly support self-directed lifelong learning. I’ve been reading books and blogs on personal finance, taking writing courses at the local community college, listening to podcasts, and attending conferences to learn from peers. As I write this article, I’m currently enrolled in a $2,000 online course teaching me how to build a better online business.

The more you learn, the more you grow, and the higher your value in the workplace.

Pro Tip: A key shift in my personal life was moving from passive/consumptive hobbies (TV, computer games, watching sports) to active/productive hobbies. I find more joy in activities that produce tangible results, such as reading, writing, web design (or exercising or building something). These activities help me make more money.

More Work, Better Work

Education is not the sole factor influencing your income. Your salary also depends on the quality and quantity of your work. To increase income, you can raise the number of hours worked per week, output per hour, or the value of your output.

The quickest and easiest way to boost income is to add more hours to your workweek. This may involve transitioning from part-time to full-time employment, working overtime, or even securing a second job.

Balancing two jobs can be challenging, especially for those with young children. Some individuals feel that having a second job compromises their identity. To overcome these objections, recognize that a second job isn’t a life sentence; it’s a way to expedite income growth in the short term.

I know a high-earning biologist who works at a high-end clothing store during the holiday season. She earns extra cash and enjoys employee discounts, enabling her to build her professional wardrobe at a lower cost.

Following the aforementioned computer course, I found part-time jobs that leveraged my new skills. For a period, I worked almost 80 hours per week. While the hours were long, the money I earned helped pay off my debts.

When my ex-wife taught high school science, her colleagues often took full advantage of the summer break. They worked at bookstores, served as tour guides, or even worked part-time as bartenders!

If extending work hours is not an option, you can increase your value by doing more within the time available to you. If you used to produce ten small components per hour, challenge yourself to increase it to twelve. If you made forty sales calls per week, find a way to make fifty.

When you produce more, your value increases.

In addition to increasing workload, improving work quality is also worthwhile. It may seem obvious, but you’d be surprised how many people go through the motions at the office every day. If you’re just pretending, you’ll never surpass others.

Providing advice on how to do a better job is challenging. Quality of work varies for everyone. However, you know what constitutes high-quality output for your profession. If you don’t know, it’s a problem you should address immediately.

Market Yourself

Your income is determined by the value the market places on you. It’s based on the demand for your knowledge and skills, the quality and quantity of your work, and how cleverly you market yourself to potential employers or clients. If you have specific skills, you can easily earn money by selling your services or teaching others.

If you want to make more money, you must be more valuable.

The market’s perception of what’s valuable may seem unfair to you, but “fairness” is irrelevant. Professional athletes receiving such high compensation—is it unfair? Perhaps. Should teachers be paid more? Maybe. But that’s not important. These figures are products of supply and demand. If you want to increase your income, you must provide more of what employers need.

Negotiate Your Worth

Whether you like it or not, you are a product. Your work and expertise are commodities.

Your employer wants to pay as little as possible for your work. Your goal is to get the compensation you deserve. To bridge the gap between these two numbers, a savvy financial expert negotiates with their salary.

Imagine when you shop, you try to pay as little as possible, right? You might need that car, but if you don’t have to pay the sticker price, you won’t. Meanwhile, the dealer is trying to get you to pay more.

Your boss is the car buyer. She needs an employee but would prefer to pay less than the “sticker price.” And you’re like the car dealer. You want to convince the buyer—your employer—to pay a high price for your services.

If you learn the art of salary negotiation, your lifetime income can increase by $500,000 or even more.

Knowing you should negotiate your salary is one thing; actually doing it is an entirely different matter. What are the tricks?

In his excellent work “Negotiate Your Salary: How to Earn $1,000 a Minute,” career coach Jack Chapman advocates for a five-step process that almost anyone can use:

- Postpone salary discussion until you’re offered a job. (The same applies to raises: discuss salary increases after performance evaluations.)

- Let them make the first move. The first person to mention a price loses, so always let the employer state the salary first. (For advice on avoiding questions about your salary expectations, see this video and this article.)

- When you hear the offer, repeat the highest figure and then stop talking. This “hesitation” is a performance that buys you time while putting pressure on the employer.

- Counter the offer with researched responses. Before the interview, do your homework to understand the reasonable salary range for the position. Use this knowledge to negotiate more compensation. (Start your salary research on websites like Glassdoor and PayScale.)

- Close the deal and then negotiate. Once your salary is locked in, you can negotiate additional benefits, such as extra vacation days or a company car.

According to a 2011 study in the “Journal of Organizational Behavior,” not negotiating your starting salary could result in a loss of $600,000 over a typical career.

The same idea applies when asking for a raise. Of course, the difference is whether your company already knows if you’re an asset or a liability. To increase your chances of getting a raise during the next performance evaluation, be prepared to state your reasons. Market yourself!

In the United States, only about half of employees negotiate their salaries. Financial experts always do.

Note: Another way to market yourself professionally is to develop a continuous portfolio of achievements in the workplace. This will come in handy when asking for a raise or applying for a new position. Networking with colleagues during seminars and conferences is also a way to showcase your skills and abilities.

You are 100% responsible for your income.

Your income directly reflects the value the market places on you. It’s based on the demand for your knowledge and skills, the quality and quantity of your work, and how cleverly you market yourself to potential employers or clients. If you have specific skills, you can easily earn money by selling your services or teaching others.

If you want to make more money, you must be more valuable.

The market’s perception of what’s valuable may seem unfair to you, but “fairness” is irrelevant. Professional athletes receiving such high compensation—is it unfair? Perhaps. Should teachers be paid more? Maybe. But that’s not important. These figures are products of supply and demand. If you want to increase your income, you must provide more of what employers need.

+ There are no comments

Add yours